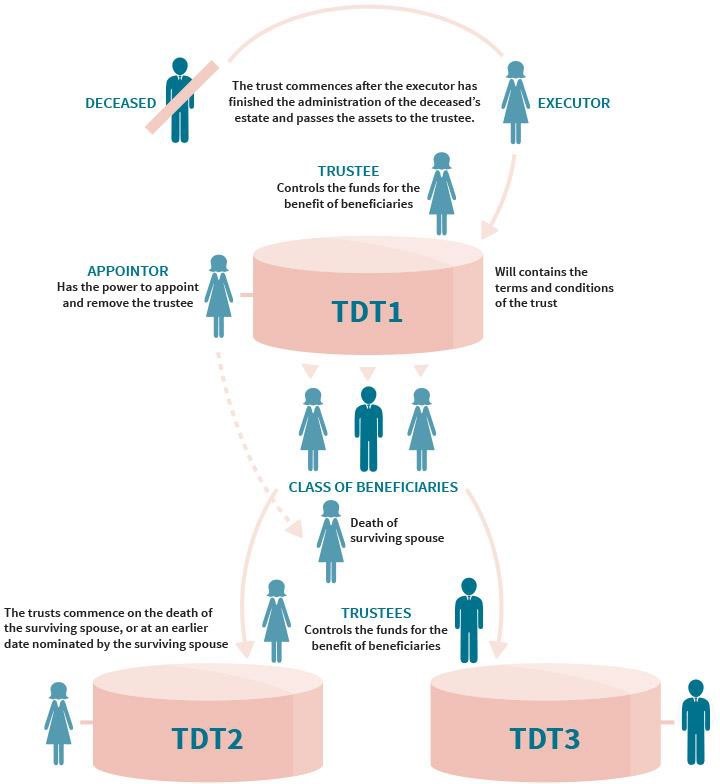

Cascading Testamentary Discretionary Trusts (TDTs) refer to an estate planning structure whereby the assets of one TDT are transferred (or ‘cascade’) into one or more TDTs on the happening of a specific event.

For example, say TDT1 is established for the benefit of the surviving spouse and any children.

The terms of TDT1 could provide that when the surviving spouse dies, or on an earlier date nominated by the surviving spouse, the capital of TDT1 is to be distributed equally into TDT2 and TDT3.

TDT2 and TDT3, for instance could be established for the benefit of the original testator’s two children and their respective families.

Another approach to this model is for a will maker to leave their children the use and enjoyment of their assets and income from those assets at the TDT1 level, with the will maker’s grandchildren to benefit from the assets at the TDT2 and TDT3 level when their parents (the children of the original will maker) die.

This mechanism is explained in this diagram.

What are the benefits of a Cascading Testamentary Trust and when should they be used?

Simplicity by reducing the need to set up multiple TDTs initially and allowing the estate to be divided into specific discrete TDTs at a later and more appropriate time.

Asset protection as on the death of the surviving spouse, this asset protection extends to adult children of the relationship as the assets in the original TDT now become assets of the children’s respective TDTs.

Problem beneficiaries by having a TDT that allows someone else to manage the child’s inheritance in a controlled way, whilst other children without such issues are free to have their own TDT which they can manage themselves.

Large estates that are likely to produce substantial income over the long term across the generations, cascading TDTs are useful in order to ensure the ability to keep estate assets within these trust arrangements. This can be of assistance where there is a large asset within the estate or a collection of significant assets which have the potential to benefit the family in the longer term if managed well.

Blended families where a TDT could be set up for the surviving spouse, so that on the death of the spouse, further TDTs for particular individual children, say those from the first or the second marriage (or both), automatically arise.

If you would like further information about Cascading Testamentary Trusts, please contact our office on 07 3123 5700.